Congress does not get very much right, but its enactment of the Small Business Reorganization Act (SBRA) is one success it can take credit for.

We have written before about how and why we perceive Subchapter V of Chapter 11 to be a boon for business. See our January 2020 newsletter and this article of mine also from January, 2020, published by the Wisconsin State Bar:

https://www.wisbar.org/NewsPublications/InsideTrack/Pages/Article.aspx?Volume=12&Issue=1&ArticleID=27422

Sub V was enacted because Congress finally realized, after more than 40 years, that Chapter 11 was not working for small businesses. Chapter 11 was slow and cumbersome, and far too expensive. Most importantly, Chapter 11 only allowed a debtor to restructure with the affirmative consent of creditors or by paying all the creditors in full. Chapter 11 was the only form of bankruptcy which gave creditors such a degree of control.

Sub V, in contrast, is faster and has less red tape. It is far less expensive. Most importantly, Sub V eliminates the absolute priority rule which gave creditors so much control over the reorganization process.

Our experience with Sub V has been very positive. Every case we have filed has had a plan confirmed or is still pending. But how does our experience compare with that of others around the country?

A recent article by Hon. Michelle M. Harner, Emily Lamasa, and Kimberly Goodwin-Maigetter in the ABI Journal provides the answers. Using data collected by Ed Flynn, an ABI consultant, the authors reviewed the data which existed as of June 30, 2021. That data covered cases from the effective date of the SBRA which created Sub V, through the end of 2020, a period of about 10 months.

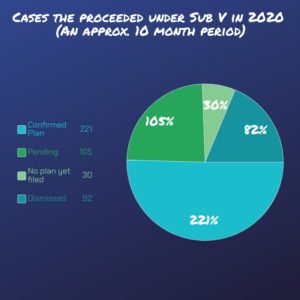

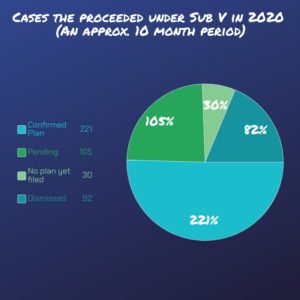

The study looked at the 438 cases that proceeded under Sub V. Here is what they found (see pie chart, below).

The majority of these cases already have a plan confirmed! Less than 20% were dismissed! These statistics are dramatically better than what we saw under regular Chapter 11. And this confirmation rate may be substantially higher when we get the results for the 135 cases which have plans pending or not yet filed. Small business cases filed between 2008 and 2015 had a confirmation rate of only 25.3%.

We have been ardent supporters of Sub V. We see with our own eyes how well our clients are faring. Now the numbers confirm these results.

Unfortunately, many small business owners are not aware of this available option. And many of their lawyers are not either. We will continue to spread the word, because our motto is “Keeping Businesses in Business.”

Sub V Bankruptcies

The use of Sub V has also spread to farmers. See our recent article published by the Rural & Ag for Cultural law blog for the Wisconsin State Bar: https://www.wisbar.org/NewsPublications/Pages/General-Article.aspx?ArticleID=28641